|

Navigation: Purchasing (Main Module) > Setup System Cost Center History/Budget Settings |

Scroll Prev Top Next More |

PURCHASING > Setup system > Cost center history/budget settings

These settings affect Cost Center History and Budgets.

•To purge all or some cost center history, use Purge Cost Center History. •To purge all or some cost center budget data, use Delete Old Cost Center Budget Fiscal Periods. |

Cost Center History/Budget Settings Screen

Field |

Description |

|

History Committed based on: |

•For Purchase Order related transactions, the cost center history can either be charged on the invoice date or the payment date (i.e. taking into account the terms of payment for each invoice). •Your choice will affect the date that is stamped on each transaction in cost center history. |

|

Years of History to display when viewing Cost Center History: |

•This setting determines how many years (back) if cost center history will be displayed on the screen in areas where you are not specifically prompted to enter a cut-off date. Since some organizations maintain many years of history for audit purposes, displaying the full cost center history can be overkill. |

|

Enable Cost Center Budget Calculation Utility? |

•Check this box to enable the cost center budget tracking feature. •Doing so will give you access to the remaining fields, below, so that you can configure the budget tracking features, as well as access to the applicable fields in the Cost Center Master File to enter budgets for each cost center. •Note: You must Recalculate Cost Center Budgets to initially calculate statistics based on transactions that are already in the system. From then on, new transactions will update budgets as they are processed. |

|

Number of Periods for Cost Center Budgets: |

•This refers to the number of time intervals/periods PER YEAR that you are tracking for fiscal (time-based) budget. For example, if you have yearly budgets, enter 1. If you have quarterly budgets, enter 4. If you have monthly budgets, enter 12. •Regardless of this setting, you can set up budgets for as many fiscal periods (years) as required, using the [CREATE NEW FISCAL PERIOD] button at the bottom of the screen. •If you do not plan to track fiscal (time-based) budgets (i.e. if you will only be using overall budgets, enter “1”. |

|

Budget begins on which day of the month? |

•Typically, budgets would start on the 1st day of the month but the starting day can be from 1-28. Budgets cannot start on the 29th, 30th or 31st day of the month. |

|

Budget begins in which month of the year? |

•If your fiscal budget corresponds with the calendar year, enter “1” (for January). Otherwise, select another month. |

|

|

Item Requisitions |

•These settings determine what to do when a budget will be exceeded by processing the respective transactions. SpendMap will compare the value of the document/transaction to the amount remaining in the budget and, if the budget will be exceeded, the user can either be stopped or warned. •If you are prohibiting the processing of transaction that exceed budget and you back-date transactions, the fiscal period must be active in order for you to process transactions in that timeframe - if the budget period is not active, it is the equivalent of having no budget). See the "Number of past fiscal years to keep active" field, below. |

|

Start warning users when (budget threshold %) |

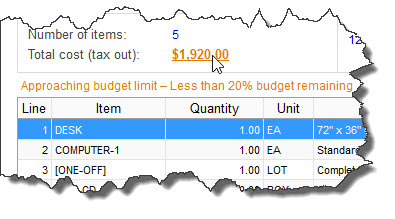

•You can optionally specify a “threshold” (e.g. 20% of budget remaining), after which SpendMap will start warning users that they are approaching the budget limit when working on POs and other transactions. Enter "0" (zero) to disable this threshold warning. •The hyperlinks on various screens that display budget information will change from green to yellow when the threshold has been reached, and then finally to red if the budget is exceeded. In some cases, additional "Approaching limit" indicators will also be displayed...

•In addition, the color of the rows on browse lists that show budget data will be color-coded accordingly. |

|

Number of past fiscal years to keep active |

•This setting determines 1) how many past fiscal years of budget data you can see in View Cost Center Budgets, and 2) if you are restricting the processing of new transactions using the above settings, this setting determines how far you can back-date transactions (a fiscal period must be active in order for you to process transactions in that timeframe - if the budget period is not active, it is the equivalent of having no budget). •This is a performance-related setting only, which determines how much information/data SpendMap needs to process and maintain. Limiting the number of past fiscal periods will improve system performance for day-to-day transactions and inquiries. However, you can maintain more fiscal years' worth of budget data if you wish (i.e. using the [CREATE NEW FISCAL PERIOD] button, below). If you have more fiscal years set up, you can still report on those older budget periods, using the Cost Center Budget Report. Also, if need be you can increase this setting (and then recalculate the budgets) at any time, to have access to earlier fiscal periods when viewing budgets on-screen. |

|

Enable use of OVERALL budgets? |

•In addition to “time-based” budgets (e.g. monthly, quarterly, annual, etc.), SpendMap can track “overall” budgets, which are independent of time, such as when tracking a Project budget that might span several years. •Check this box to enable “overall” cost center budget tracking. Doing so will give you access to the applicable fields in the Cost Center Master File to enter overall budgets for each cost center and/or G/L account. •If you do not need to track overall budgets, do not check this box as it will impact system performance since additional information must be stored and calculated to maintain overall budgets. |

|

Budgets committed based on: |

•For PO-related transactions, budgets can be committed (incremented) based on either the delivery date or document date. •Many organizations commit budgets on the PO date as this is the date that the financial commitment to the supplier is made (even though money might not change hands for weeks or months, until the invoice is paid) whereas some prefer to charge budgets on the delivery date of items since this is closer to the date that money changes hands (albeit likely more removed from the date of the original financial commitment). •This setting does not affect inventory usages, which always charge the cost center’s history and budget on the actual date of the usage.

|

Button |

Description |

[CREATE NEW FISCAL PERIOD] |

•This is used to create new fiscal budget periods (i.e. budget years). Doing so will give you the ability to enter budgets for those fiscal periods/years in the Cost Center Master File, and view and report on the status of the budgets. •Also, if you are restricting the processing of transactions using the settings for each document/transaction above, creating the fiscal period will allow you to process transactions in that timeframe (if the budget period has not been created, it is the equivalent of having no ($0) budget). STEPS1.Select a fiscal period (year) to create. 2.If budgets have already been established for other periods/years, you can either [COPY] the budgets from another year to save data entry/setup or you can start with [BLANK] budgets and enter the values from scratch for each cost center. This is just a starting point; you can copy another year’s budgets to save time and then modify budgets for one or more cost centers, as needed. |